Know your

Credit History,

anytime!

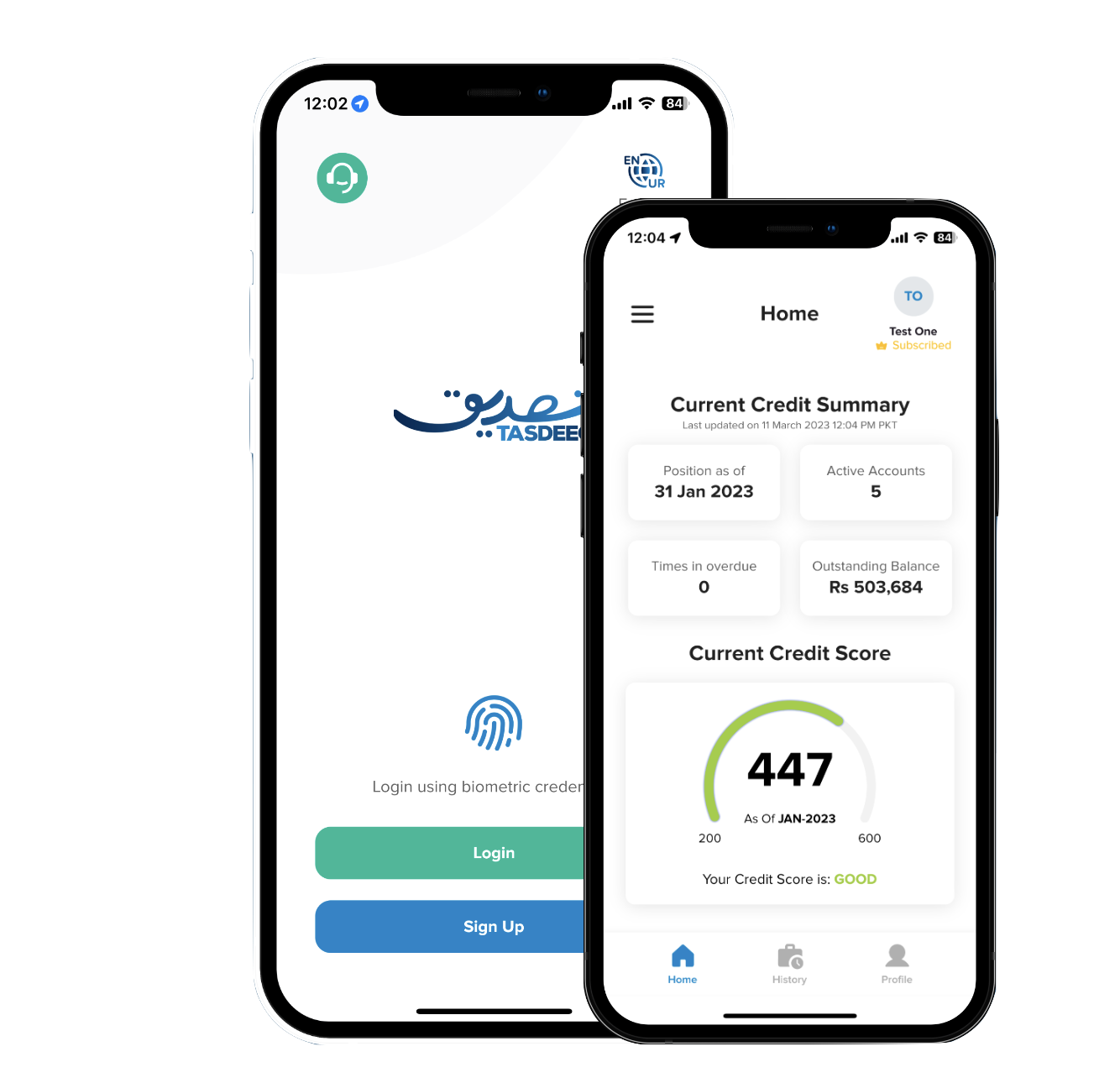

With TASDEEQ App, your credit report

and score are just a tap away.

Download Now

TASDEEQ APP

Download now and monitor your credit score and report on-the-go

Be Future Ready: With TASDEEQ’s advanced data driven solutions

Make better decisions through our innovative products and services that provide meaningful insights and promote financial inclusion.

Mitigate Risk, Enhance your Business and Acquire more Customers with TASDEEQ

Our innovative approach to data, technology and advanced analytics drives insights that enable you to make quick decisions with confidence.

Services We Offer

Gain valuable insights into your customers' financial health with TASDEEQ's comprehensive credit solutions. Our range of services, including credit reporting, monitoring, and data analytics, equips businesses with the tools they need for informed decision-making. Assess creditworthiness, manage risk, and drive business growth with TASDEEQ.

CIR Report

Basic regulatory requirement to make credit evaluations easier for lending institutions

Portfolio Scrub / Review

Flagged for limit enhancements, cross-product offerings and defaults

CIR Plus Report

Provides you with the information to determine the household’s overall indebtedness

Business Growth Analytics

Analyze and identify new business opportunities through SMS marketing

Telecom Risk Profile Index

Insights on individual customer’s financial situation for customized products and services.

Member Status

We are growing every day, with members from banking and financial institutions across Pakistan providing insights on 18 million records.

Overall Tasdeeq Database

100%

Total Number

Borrowers

Commercial Banks

100%

Total Number

Borrowers

Average History

Microfinance Banks

100%

Total Number

Borrowers

Average History

Microfinance Institutions

100%

Total Number

Borrowers

Average History

Other Members

40%

Total Number

Borrowers

Average History

Note: There are 5.7M Overlapping Borrowers among the above Financial Institution Types.

Become a Member

Our members have access to consumer Credit information Reports (CIR), Credit Scores and other innovative services that make lending easier.

Latest News

Browse latest news and customer events

TASDEEQ took the stage at Pakistan Startup Summit 2024 organized by SECP

November 2024

TASDEEQ took the stage at Pakistan Startup Summit 2024 organized by SECP

The discussion centered on striking the delicate balance between harnessing data for growth and managing associated risks, emphasizing the critical importance of robust data protection in today’s digital era. Each leader shared invaluable insights from their experiences, showcasing how data drives smarter decision-making, fosters innovation, and builds trust.

Tasdeeq team attended a session on "Mobilizing Funds from Capital Markets to Achieve Sustainable Development Goals" at the Pakistan Stock Exchange Limited

October 2024

Tasdeeq team attended a session on "Mobilizing Funds from Capital Markets to Achieve Sustainable Development Goals" at the Pakistan Stock Exchange Limited

During the session, he shared his valuable perspectives on listing microfinance providers on the Pakistan Stock Exchange to boost liquidity and drive growth. He emphasized prioritizing larger microfinance providers as a strategic step to pave the way for others in the sector.

TASDEEQ took part in Annual Microfinance Conference AMC8, hosted by the Pakistan Microfinance Network.

October 2024

TASDEEQ took part in Annual Microfinance Conference AMC8, hosted by the Pakistan Microfinance Network.